Between 19 May and 15 June 2013, the average listener in Bangalore spent 19 hours tuned into the radio. In Delhi and Kolkata, it was 15 hours each. In Mumbai it was 12. This is according to information tabulated under Radio Audience Measurement (RAM) - an independent division of TAM (Television Audience Measurement) Media Research.

Radio is today one of the fastest growing media channels in this country. According to a March 2013 report by FICCI (Federation of Indian Chambers of Commerce and Industry) and KPMG, “Radio is anticipated to see a spurt in growth at a CAGR of 16.6 percent over the period 2012-2017, post the rollout of Phase 3 licensing.” Given its growth potential, it would naturally be critical to have an index of reach and impact that the industry would subscribe to, by and large unanimously, as various players, old and new, compete with each other. So, is RAM poised to secure that very significant role as radio reaches the next level? Think again!

While data as quoted in the opening lines are still digested by most radio operators and advertisers, the cracks are beginning to show now; the year 2012 saw at least two radio stations turning away when Radio Indigo and Red FM stopped their subscription to RAM.

Ask them why, and you would find a host of reasons, though largely along the same lines - lack of credibility, inefficiency, unreliability and so on.

Chennai-based B Surendar, Chief Operating Officer (South), Red FM says, “We used to subscribe to RAM but felt that it was very insensitive to changes. It requires more credibility. It requires improvements.”

Sanjay Prabhu, Managing Director, Radio Indigo, Bangalore says, “We have made several representations but they (RAM) have disregarded this. So last year, we stopped subscription”.

At a time when questions are being raised about Television Audience Measurement, trouble seems to be brewing for RAM too.

•

People's airwaves, but controlled

•

Unexpected sounds in the South

The RAM story

It was in 2007 that TAM Media Research expanded its base to launch RAM as a joint service guided by the expertise of IMRB International and Nielsen Media Research. This was after months of discussion with radio broadcasters, advertisers and agencies. The stakeholders felt the need to measure listenership, in a manner similar to television ratings. The radio stations involved in these discussions were Radio City, Big FM, Red FM, Hit FM and Fever 104.

TAM Media Research says that the service was introduced to provide a measurement of radio listeners and tap the growth of the radio industry. RAM initially covered three cities - Bangalore, Mumbai and Delhi. The following year, Kolkata was also included. (From 2011, RAM also measured data bi-annually in nine other cities including Ahmedabad, Chennai, Hyderabad, Indore, Jaipur, Kanpur, Lucknow, Nagpur and Pune.)

RAM data includes the average number of listeners tuned into a particular radio station on an hourly basis and the amount of time listeners spend listening to a station.

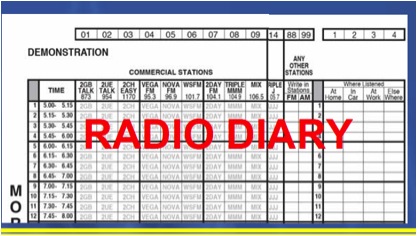

Unlike the methodology followed in TAM, RAM follows the more archaic ‘diary method’. Samples of people are selected based on age, economics and other factors. (One-third of the panel is changed every quarter.) Those selected for the measurement are each given a diary. Each time you listen to the radio, a tick mark must be placed beside the name of the radio station you are listening to and the time of the day.

A typical 'radio diary' used in RAM computation. Courtesy: TAM Media Research

Every week these diaries are collected by RAM’s field persons and a new diary is given for the next week. These individuals also clear doubts that one may have about the method. The diaries are then sent to a Central Processing Zone where it is decoded. A Validation Team in Mumbai then checks the entries for anomalies.

In all there are about 560 such diaries each in Bangalore and Kolkata, and 660 each in Mumbai and Delhi.

As it happens, this sample size is itself one of the points of contention of stations like Radio Indigo and Red FM that withdrew subscriptions last year.

Sample size does matter

Prabhu of Radio Indigo says the sample size is too small. “We had even written to RAM about this. They said they will look into it”, he says. For a city like Bangalore, with a population of over 8 million, Prabhu says the sample size should not be less than 5000. Surendar of Red FM also feels the meagre sample size is bound to result in data that is insensitive and not reflective.

Sanjay Prabhu (second from right). Photo: www.indigo919.in

National Marketing Head of Radio Mirchi in Mumbai, G G Jayanta feels similarly. “A sample size of 500-600 measuring the listening habits of 150 lakh people in Delhi/Mumbai or even 50-60 lakh people in Bangalore does seem inadequate,” he feels.

Diary method v/s electronic method

Sample size, however, is just a small piece of this bitter-tasting pie. Radio operators like Radio Indigo and Red FM who pulled out their RAM subscriptions raise some pertinent points about the very methods of measurement.

Surendar says a measurement currency must serve two purposes - help advertisers to justify spending, and guide industry players to make changes in their product. “I would like to have a credible measurement currency so as to justify the money invested,” he explains. Clearly, in his mind the methods followed by RAM do not live up to that.

Jayanta says, “There is little transparency on universe computations, its updation etc”. He also feels that since so many listen to radio on mobile phones, electronic data-gathering must be used to capture these listening methods.

As it appears, finance may be a key issue here. TAM Media Research’s Senior Vice President of S-Group and Marketing, Pradeep Hejmadi, responds. “Conducting RAM is not providing us with any margin. We show all the players the cost before it is approved”.

Even as the exchange of words over RAM continues, it is evident that most stations would prefer the electronic method over the diary method of gathering data. The diary method is subject to errors arising from the method itself, as the subjects may enter incorrect data into the diaries. Most radio stations, therefore, feel the need to migrate to the electronic method.

Divyashree, Cluster Programming Head, Big FM (Bangalore), says that when international stations have all switched to the meter method, “somebody needs to take the initiative to change this.”

Even advertisers and agencies agree. Mumbai-based Vanita Keswani, who is the Chief Operating Officer of Madison Media Sigma, says, “The evolution to electronic method would definitely be welcome”. Madison Media Sigma is a division of the communications agency Madison World and is subscribed to RAM.

Radio Indigo, Red FM and Radio Mirchi say they have individually communicated most of their concerns to TAM Media Research. However, the latter says that most stations started complaining only when their expectations around rankings and listenership were not met. As Hejmadi puts it, “Everybody wants to be No 1, no one expects to be No 2. On receiving their complaints, we offered them electronic methodology. This is more accurate but will cost the stations Rs 1.2 - Rs1.3 crore annually. We have even opened ourselves to the option wherein the stations purchase the electronic metres (sic) independently while we only focus on the sampling and analysis”.

Pradeep Hejmadi. Photo: TAM Media Research

Hejmadi goes on to say that RAM is still fulfilling its commitment of conducting research on audience and holding talks with radio executives. However, after offering the players to arrange for a panel for electronic research, the stations have not got back.

While TAM Media Research claims they had called for a meeting in December 2012 to hold these discussions, most stakeholders say they are not aware of any such communication. Jayanta says a meeting was called in September 2012, which Mirchi had attended. “As far as my knowledge goes there was no meeting called in December 2012,” he says adding that the station had never heard of any proposal from RAM on cost augmentation associated with a switch to the electronic method - “not in the last one year or so at least.”

Relevance of RAM

Clearly, there is a communication gap between the stations and RAM, but even if that were bridged and stations given another chance to have an upgraded system at a cost, would the index in itself justify that? How accepted or valued is the RAM rating among all stakeholders?

Apart from the Indian Readership Survey (IRS), RAM is the only measurement currency available to radio operators and advertisers. Among the radio stations confirmed to be subscribed to RAM are Radio Mirchi, Radio City, Big FM, and Fever 104. TAM Media Research refused to share details about the names of subscribers both among radio operators and advertisers.

Vanita says, “RAM listenership data is certainly given importance... Within RAM we usually utilize the cume reach numbers of stations to evaluate the station strength in terms of reach.” Cume is short for ‘cumulative audience’ and is a measure of the total number of unique listeners over a specified period.

M.K. Machaiah of Mindshare

Bangalore-based Mac Machaiah, Principal Partner - Client Leadership at Mindshare, a global media agency network subscribed to RAM, says that since the measurement captures live data, which is dispersed every week, they do use it as an indicator of reach. But even so, he says that an element of common sense must be used when deciding which station to advertise on. Machaiah gives the example of how a brand may want to advertise on a channel like Radio Indigo even if it doesn’t figure on top of RAM’s ratings, if the station has a niche audience or a specific target group that the particular brand also wants to tap.

Jehil Thakkar, Head of Media and Entertainment, KPMG, says RAM ratings are an important indicator of listenership. “There is no other measurement available. So they (radio stations and advertisers) do take it seriously”. Most radio stations agree. Surendar says, “Ratings do influence ad revenue.”

Divyashree of Big FM says the channel takes RAM very seriously, at least at the content level. “RAM does rule the station’s mood internally. There is a lot of pressure. It affects strategies and the way forward.” She says RAM data has shown that the station is doing well in terms of number of listeners tuning in, but lack in TSL (time spent listening). Such findings urge them to look deeper into what went wrong.

Having said that, she also says that it may not be correct to follow RAM alone and that one should also note the quality of the product being offered. “It has happened several times that we have had a great week but the ratings haven’t reflected that. But then we know we have done some good programming.”

From a revenue point of view, RAM may not have a very critical contribution as it is certainly not the sole criteria that advertisers look at, when zeroing in on a particular channel. Both Vanita and Machaiah say they also look at the brand, innovation and overall content. Advertisers conduct their own research, and so do radio operators, to understand the pulse of the market and the listener. Surendar says Red FM undertakes several on-ground and on-air initiatives. “We also look at social media responses and phone calls. We share all this with our advertisers and tell them how their brand can be integrated.”

Suresh Pendakur, Managing Director of Fiesta Vacations, a company that frequently advertises on at least three private FM stations in Bangalore, says they don’t look at ratings. “Basically we make our choice based on popularity... We keep talking to our customers... we gauge the sentiments of youngsters... we also decide based on the RJ, whether he or she is a crowd-puller.” He says they don’t trust ratings. His company makes sure they don’t advertise on stations that have too many ads and too little programming.

Prabhu of Radio Indigo concurs in that local advertisers don’t really look at RAM, but feels that it could hold some currency with ad agencies and clients outside the city. Radio Indigo is Bangalore-based and is placed last according to RAM’s recent weekly figures.

Hey RAM!

That RAM needs to evolve seems to be largely agreed upon, both by stations and agencies that use it. Machaiah says given the increase in investments in the radio sector, the measurement system must also be better. “I mean, it isn’t like radio isn’t doing well (financially)”.

Surendar says, “I don’t think people will say no to RAM if it comes out with a credible idea... Radio can grow faster. Not just RAM, but any currency needs to be credible.”

TAM Media Research’s argument is that since the request for listenership data comes from the users themselves (in this case radio operators and advertisers), the onus is on them to increase investment; on the other hand, users continue to harp on the need for an upgrade in methodology. Clearly, there seems to be a lack of dialogue between these parties.

At this juncture, speculation is rife that TAM is likely to switch to doling out ratings on a monthly basis instead of every week. This comes just weeks after several networks pulled out of their subscriptions to the television measurement currency. Prabhu asks, “When TAM itself has been disregarded by some networks, what will you say about RAM then?”