The vulnerability of the Indian economy to the performance of the agricultural sector despite other macroeconomic indicators and sectors gaining in strength is well known. For example, the Indian economy grew at an estimated 3.7 per cent in 2002-03 against 5.6 per cent during 2001-2. This was largely because of the negative growth of 4.4 per cent in the agriculture sector.

Just prior to the current swing into election campaigning, policy pronouncements of the Government were largely agriculture and rural centric. The constitution of a Farmers Commission is one among them. Rural credit is emerging as a focal issue and this can be gleaned from the fact that the Government earmarked Rs 15,000 crore in the Interim Budget to revitalise the co-operative structure. The Tenth Plan (2002-2007) has set an ambitious average GDP growth of 8 per cent per annum.

To achieve this, it is important to revitalise and revamp not only the agricultural sector but also rural financial institutions. An annual average growth of 7 per cent from this sector alone in the next five years is crucial for achieving the GDP target. The Task Force on Rural Credit for the Tenth Plan has projected institutional credit flow to agriculture and allied activities at Rs 7,36,570 crore for 2002-2007, which is more than treble (320 per cent) the credit flow (Rs 2,29,853 crore) during the Ninth Plan (1997-2002).

This article will do a broad review of the state of rural banking and credit in the country, compare this with urban areas, assess the banking divide, point out candidate institutions for strengthening in the light of the challenges in an era of reforms, and finally draw a roadmap consisting of policy and institutional reform components.

1. Current trends in rural banking and credit

First lets look at some broad banking data. The 2001 Census figures brought out an alarming picture about the usage of banking services among Indian households in urban and rural areas despite the wide banking network in the country. The following table reinforces the conclusions about the low level of banking usage among Indian Households in general (35.5%) and Rural Households in particular (30.1%) and also reflects the latent demand for general banking needs in rural as well urban segments.

The absolute numbers of bank branches has seen an increase in urban areas, while there has been decline in the rural areas. (click table-2 to see)

Credit as an indicator of economic activity

As per statutory requirements, Banks need to maintain Cash Reserve Ratio (CRR) and Statutory Liquidity Ratio (SLR) to the extent of 4.5% and 25% of their deposits respectively. Accordingly, for every hundred rupees of the bank deposits, around Rs.30 is preempted under SLR and CRR obligations. The banks can lend the remaining amount i.e Rs.70.

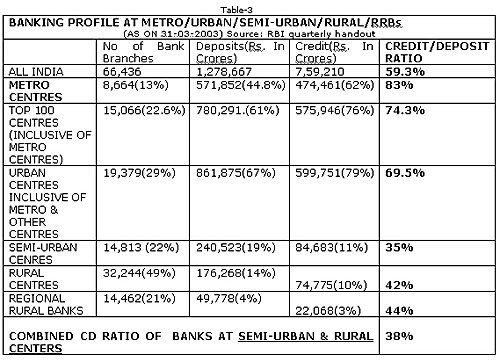

The CD ratio can be 70% at most, but that often is not reached. In fact, post the onset of financial reforms, credit driven economic activity at rural and semi-urban branches has plummeted to the levels prevalent during the period of nationalization of banks.

Post the onset of financial reforms, the exclusive CD ratios at rural and semi-urban branches have almost plummeted to the levels prevalent during the period of nationalization of banks. In a developing country like India, the availability of credit is major input for any activity. From the table of CD ratios, it will be noted that CD ratio in urban India is very high beyond 60%, when compared to rural/semi-urban sector. This indicates that the rural/semi-urban branches are being used for mobilization of savings, but not for deployment of credit. Low CD ratios also indicate that Banks are not playing major role in credit expansion in particular segment/sector.

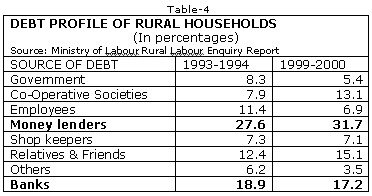

This situation matches up with the debt profile of rural households which still reflects inadequate institutional credit flow.

These trends broadly indicate that despite the widespread banking network in place, there is a continued migration of rural/semi-urban savings (to the minimum extent of Rs.1,32,295 crores) to urban/metro centers, thereby causing a banking divide a la digital/rural-urban divide. In order to obviate the regional or urban/rural imbalances, the minimum benchmark CD ratio of 60% should be envisaged in all districts of the country. That will assist broad-based and equitable credit expansion thereby contributing enhanced economic activity. The reason urban India is reflecting enhanced economic activity post-reforms is the availability and expansion of credit for housing and consumption purposes.

Agricultural credit

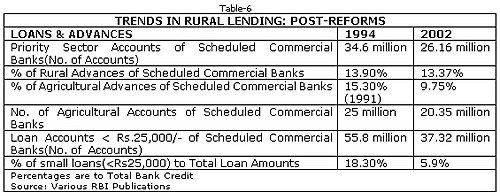

An equally important concern that needs attention is the flow of institutional credit to agriculture. The growth of commercial banks lending to agriculture and allied activities witnessed a substantial decline in the 1990s as compared with the 1980s. Agricultures share in scheduled commercial banks total outstanding credit as on 31-3-02 was only Rs.64,008 crores or 9.8 per cent. Even if we include loans for food manufacturing and processing (rice, sugar, edible oil, tea, fruits and vegetable processing), this share works out to Rs. 84,750.22 crores or 12.90 per cent, way below the stipulated target of 18 per cent. The total agricultural lending by commercial banks(as on 31-3-2002) is now lower than even their outstandings in personal loans (Rs.82,518 crores in 17.59 millions of accounts) portfolio comprising loans for housing, consumer durables, and so on.

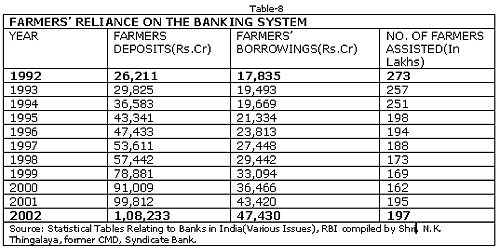

Similarly, post reforms, the banking system has mobilized more deposits from farmers and extended less credit to declining number of farmers as illustrated here under:

Many scheduled commercial banks are shying away from agriculture and priority sector lending. For example, the commercial banks have an excess investments portfolio beyond the required limits of 25 percent. The table below illustrates the declining penetration in rural banking post-reforms, compared to an excess investments of scheduled commercial banks in treasury securities (gilts).

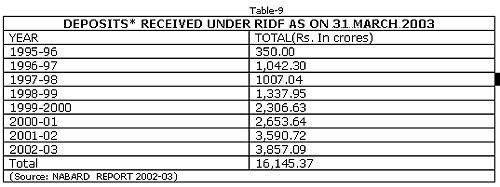

Furthermore, scheduled commercial banks are resorting to the soft window option of investing in the Rural Infrastructure Development Fund (RIDF) of NABARD. Contributions to the corpus of RIDF are received by NABARD by way of deposits from Scheduled Commercial Banks against their shortfall in priority sector/agricultural lending during the preceding year. The outstandings at the end of March 2003 stood at Rs. 12,159.23 crores.

2. Government's response to the rural credit scenario

While the current situation may not look promising for rural credit, it isnt that governments have been inactive all the way. In fact, in the early 1970s itself the Central Government observed that despite a wide banking network and developmental initiatives in the first 25 years since Independence, a critical gap still existed in meeting the credit needs of the rural poor. To find a solution, the Government appointed a working group on rural credit, the Narasimhan Committee, in July 1975. The committee observed that the cost structure of commercial banks, the attitude of bank employees and the lack of a professional approach in the co-operative credit system were the main stumbling blocks to rural credit. The committee also observed that the deposits collected by banks from rural areas were not totally deployed there. The panel, therefore, recommended the creation of a new set of regionally-oriented rural banks which would combine a co-operative's local feel and a commercial bank's business acumen.

Regional Rural Banks emerge

The Government accepted these recommendations and, accordingly, the ordinance of Regional Rural Banks, 1975 was promulgated on September 26, 1975. This was replaced by the Regional Rural Banks Act, 1976 on February 9, 1976. The mandate of these rural financial institutions were to: take banking to the doorsteps of the rural masses, particularly in areas without banking facilities; make available cheaper institutional credit to the weaker sections of society, who were to be the only clients of these banks; mobilise rural savings and canalise them for supporting productive activities in rural areas; generate employment opportunities in the rural areas; and bring down the cost of providing credit in rural areas.

With partnerships with the Central Government (50 per cent), State governments (15 per cent) and commercial banks (35 per cent), the number of RRBs rose from just six in 1975 to 196 by 1987, covering 476 districts. They financed only the weaker sections of the rural community small and marginal farmers, agricultural labourers, small traders, and so on. Along with commercial banks, RRBs participated enthusiastically in poverty alleviation schemes (IRDP, for example) and disadvantaged area (drought-prone regions and deserts) development programmes. They quickly became an important and integral part of the rural credit system. However, their financial viability was initially overstretched by policy rigidities coupled with a low capital base in an environment of inadequate infrastructure and deeper social and economic disparities.

After the financial sector reforms, several measures to improve the viability of RRBs were initiated. More importantly, re-capitalisation to cleanse their balance sheets was taken up in 1993-94. Other important reform measures included deregulation of interest rates on advances as well as deposits; permission to lend to others outside target groups; provision for rationalization of branch network - relocation and merger of loss-making branches; introduction of prudential norms on income-recognition, asset classification and provisioning; preparation of development action plans and signing of memorandum of understanding with sponsor bank for sustained viability in a planned manner; provision of greater role space and larger operational responsibilities to sponsor banks in the management of RRBs; encouragement to function as self-help promoting institutions and financing of self-help groups and introduction of Kisan Credit Cards to simplify provision of production credit to their clients.

Regional Rural Banks today

At the end of fiscal 2002-3, there were 196 RRBs spread over 23 States/Union Territories and with a network of 14,350 branches, accounting for 44.5 per cent of the total rural network of all scheduled commercial banks (including RRBs). The rural and semi-urban branches of RRBs constitute 98 per cent of their network. Their deposits and advances as on March 31, 2003, were Rs 49,078 crore and Rs 22,028 crore respectively. Thus, RRBs have done well in mobilising rural deposits and infusing the thrift habit in their clients.

Out of 196 RRBs, the number of profit making banks stood at 167 in 2001-2002 as compared with 170 in 2000-2001. The combined Net Profit of RRBs for the year 2001-2002 aggregated Rs.608 crores as against the combined net profit of Rs.601 crores in the previous year. The aggregate accumulated losses of RRBs declined from Rs.2752.59 crores as on 31 March 2001 to Rs 2694.06 crores as on 31 March 2002.

As a result of the various reform measures, the RRBs showed substantial turn-around in their performance. The RRBs also displayed qualitative improvement in their NPA management and gross NPAs as percentage of gross advances stood at 16% as on 31-3-2002, down from 32.8 at March-end 1998. Similarly, the recovery performance of the RRBs steadily improved with the percentage of recovery to demand raised at 71% as on 30th June 2001 form 61.2 % at end-June 1998(41.2 % at end June1993).

The bulk of the loans from RRBs have been to priority sectors, which accounted for over 70 per cent of the total. Agriculture alone took up 46 per cent of the priority sector advances. The involvement of RRBs in providing credit support to small and retail trade and other non-farm rural activities is better than that of co-operatives and commercial banks. As on March 31, 2002, the outreach of RRBs in terms of number of deposits and advances was 50.02 million and 11.94 million respectively. Clientele for loans and deposits in the rural sector are low-value, but large volume. RRBs have served this clientele in a more productive and efficient manner vis-à-vis other Banks. Per-employee, 885 accounts are handled by RRBs against the national average of 464 accounts per employee in the banking industry.

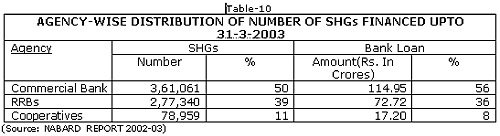

RRBs have also taken a lead role in financing of Self Help Groups( SHGs) mostly comprising of women leading to their economic and social empowerment. The share of RRBs in SHG-Bank linkage programme is equally commendable as under:

Comparison of RRBs with State Cooperative Banks

A note here about state government-run cooperative banks on how they compare with RRBs. Both rural financial institutions are in same rural credit market but with different ownership and management patterns. Indias cooperative banks were instituted in the fifties, also to meet the rural credit requirements each district of the country. They are managed by the respective state governments under Cooperative Act. There are basically three- tier cooperative structures in most of the states. Primary Agricultural Cooperatives at grass-root level, District Cooperative Bank at District level and State Cooperative Banks at State Level with each supporting the lower one.

The co-operative credit system has come under increasing pressure from the emerging competitive scenario of low interest rate regime. Cooperative Banks have also continued to suffer from several weaknesses that do not augur well for building-up their ability to compete with banking structure in the emerging liberalized environment. In part they have not been successful due to excessive political interference in their management. It may be noted that the elected boards of 478 cooperative banks out of 1186 were superseded for a variety of reasons including political interference.

RRBs on the other hand are the result of a Parliamentary Act and they are managed by the sponsor bank (which has the experience of running a big bank) with an equity stake of 35%. The Central Government and the local State Government hold 50% and 15% equity stake in RRBs. The board of RRB constitutes the officials of NABARD and RBI. Each RRB, like Cooperatives is confined to single or two districts of the country. RRBs were sought to be a blend of cooperatives and commercial banks. State governments have no/limited role in the management of the bank.

3. Challenges for rural and agricultural credit in the post reforms era

The agriculture sector to a large extent was excluded from general economic reforms initiated in 1991. However, the reforms introduced in industry, finance, banking and other sectors over the last decade have had considerable impact on the agricultural sector. The financial sector reforms have created a level playing field between rural financial institutions (RRBs and Cooperatives) and other scheduled commercial banks in treatment and in compliance of regulatory norms, without any reforms in agricultural sector.

With the demand for food increasing at more than 2 per cent per annum, the financial, land and water resources in the rural sector have come under severe strain. At the same time, agriculture is a matter of livelihood and food security, with nearly 650 million people depending on it. In this context, productivity augmentation in agriculture and other allied sectors, expansion of rural credit, poverty eradication, infrastructure and development and export competitiveness of agricultural products have assumed high priority in the nation's development agenda. It is in this context that the Rs 50,000-crore outlay has also been proposed by the Government to be implemented by NABARD.

The Rural Non-Farm Sector (RNFS) has emerged as key area of focus for creating employment in the rural sector and to enable migration from over-stretched farm sector. The future strategy of rural institutions would have to include strengthening the credit delivery system for increasing RNFS employment. Development of entrepreneurs skills, enhanced credit flow to women and other weaker sections, supporting tiny, cottage and village industries, and coverage of wide variety of service sector activities would require larger and wider role of rural financial institutions in RNFS sector.

The agricultural credit provided by cooperative banks, commercial banks, RRBs and other agencies reached Rs.70810 crores during 2002-03, a growth over 14.3% over the previous year. Public Sector investments in agriculture had increased from Rs.3919 crore during 2000-01 to Rs.4794 crore during 2001-2002, breaking the earlier declining trend. The private sector investments in agriculture and allied sectors increased from Rs.14,605 crores during 1995-96 to Rs.24,257 crore during 2000-2001 at current prices. The proportion of such capital formation financed by institutional credit increased from 59.6 to 71.5 per cent during the period between 1995-96 and 2000-01.

While all this is true, if Indian agriculture sector has to achieve sustainable growth and enhanced productivity in order to meet Tenth Plan growth targets and also at the same time to meet the emerging challenges of the WTO regime, the investments from public sector and private sector need to be increased substantially and, simultaneously, the proportions of institutional credit to capital formation should also increase rapidly. This calls for bold and innovative measures from policy makers.

The recent directions of GOI/RBI with regard to interest waiver as a part of debt relief measures and the realignment of interest rates (at 9%) on agricultural loans upto Rs.50000/- on par with commercial banks have further aggravated the viability pressures on RRBs. It is estimated that these directions on interest rate alignment would alone entail a shortfall of Rs.300-500 crores in interest income for RRBs from 2003 onwards.

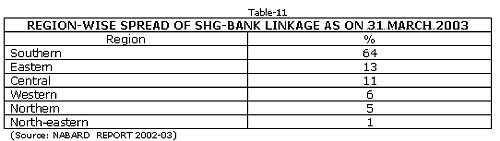

The growing role of MicroFinance through women's Self Help Groups (SHGs) for unique processes of socio-economic engineering is also important. So far, the SHG movement in the country is mostly south-centric (constituting a 64% share) and in other regions of India, it is yet to take off. The NABARD goal of reaching MicroFinance services to one third of the rural poor of the country, i.e. about 100 million rural poor through one million SHGs by the year 2006-2007 poses many challenges for rural financial institutions like RRBs, who are already actively involved in SHG-Bank linkage programme. The regional spread of the SHG movement is as under:

4. The current banking divide

RRBs and other rural financial institutions were created to exclusively serve the rural sector wherein many infrastructural deficiencies still prevail whereas commercial banks have the comfort of operating in Metro/Urban environments with obvious infrastructural advantages. However, a level playing field has been created between weak rural financial institutions and mighty commercial banks with regard to regulatory regime/practices/norms though both are operating in divergent and unequal economic backyards.

Post economic reforms, many urban-centric financial intermediaries have run into rough weather and received large doses of fiscal support from the government of India to sustain their viability. The cases in point are UTI, IDBI, IFC, and a few other nationalized banks and the support extended to these institutions/banks exceeded more than Rs.25,000 crores since 1991. It is to be noted that these institutions/banks had come under pressure even though they were mostly operating in economically attractive urban-centric backyards. And yet, fresh capital infusion in rural financial institutions is no more than Rs.3,000 crores since 1991 despite the fact that they are largely catering to the banking requirements of 75% of the population.

5. Where do we go from here - the roadmap

Against this background and growing signs of weaknesses in the cooperative banking system and the dwindling role of commercial banks in rural credit, RRBs have ipso facto emerged as the only surviving rural financial institutions with a professional management culture to meet the small-value and large-volume rural credit needs and can be easily converted into dynamic vehicles for bridging the banking divide to some extent. Therefore, the time has come for revitalising/revamping the structure of RRBs to enable them to play a critical role in the achievement of the developmental targets in rural sector under the Tenth Five Year Plan and to emerge as strong players in rural credit in order to meet the pressures arising in the agricultural sector.

In this context, the following initiatives are suggested:

Capital structure and management

RRBs need to be provided with adequate capital support to enable them to have a net capital adequacy ratio (CAR) of 5 per cent. The issue of capital infusion by the owners assumes critical importance and needs immediate attention to enlarge the scope of RRB operations. The share of sponsoring institutions in the capital structure of RRBs also needs to be enlarged to make them majority shareholders. By acquiring the majority shareholding in RRBs, the sponsor banks/institutions can convert them into vibrant and professional subsidiaries and area-specific special business units (SBUs). In the long run, they may converge all their agricultural and rural activities under the umbrella of these SBUs. Even co-operative banks can be merged with these SBUs at later stages.

Norms on non-performing rural assets

NPAs (Non-performing Assets) and IRAC (Income Recognition and Asset Classification) norms have been made applicable to the Indian banking industry after the 1991 economic reforms, to bring it on par with international banking trends. All loans given by banks need to be classified under these norms depending upon the servicing of the loan by the beneficiary. Mostly, the servicing of the loan means payment of a) quarterly interest and/or b) stipulated periodical installments of the principal.

If a loan is not serviced within the stipulated period (90 days), the loan becomes an NPA in banking parlance. For the first one year, the NPA is called sub-standard asset. From the second year onwards, the NPA is called doubtful asset. For NPAs of different categories, the banks have to make certain provisions in financial statements from their gross profit. For example, 10% of the substandard assets is to be provided each year and the percentage increases in the case of doubtful assets, ultimately leading to full provision after few years.

NABARD

NABARD has evolved over the past two decades into a strong and rural-sensitive developmental institution with complete grass-root level understanding of the complexities of the agricultural and rural sectors. The apex rural development bank has become a major shareholder in the proposed Agricultural Insurance Corporation of India Ltd, which includes General Insurance Corporation and four public sector insurance companies, to extend crop insurance cover to all farmers. Similarly, NABARD has played a pioneering role in setting up and operationalising the National Commodity and Derivatives Exchange (NCDX) with equity participation in association with other national level institutions such as ICICI Bank, LIC and NSE (National Stock Exchange).

NABARD may also acquire an equity stake in the grassroot level rural financial institutions such as RRBs from the Central Government and State governments to enable them to play a more direct and proactive role in rural credit. NABARD should thus become an apex development bank in the rural and agricultural sectors with direct equity participation in RRBs along with sponsoring institutions.

With district development managers (DDMs) in most of the districts and also on the boards of all RRBs and co-operatives, NABARD is now fully equipped organisationally and expertise-wise to emerge as a strong player in the rural credit system. A case in point is the promotion of self-help group (SHG) movements by Nabard, which reflects its immense capability in capacity building and nurturing the rural credit delivery system.

Similarly, the RBI, during the past two decades, has passed on the mantle of rural planning and credit to NABARD, its own subsidiary. Post-reforms and post-liberalisation of trade and foreign exchange, the RBI is donning the role of super regulator of the monetary and financial system. With increasing complexity of macro-economic management, the RBI needs to confine itself to a regulatory role for all financial institutions, including the rural ones. The supervisory role of rural financial institutions needs to be restored to the RBI for effective monitoring and control.

Bring down the cost of rural credit

A different dispensation under CRR and SLR would make available more resources for rural credit deployment. The rate of interest paid on CRR balances held by these rural institutions might also be 100 basis points above what is paid to commercial banks. Similarly, the Central Government and all State governments need to park their rural developmental funds with RRBs to ensure cheaper flow of demand deposits. These simple measures, without any cross-subsidisation, would bring down the cost of credit to the rural/agricultural sector.

Raising the bar

At the same time, the stipulated 18 per cent benchmark for lending to agriculture needs to be hiked to 25 per cent commensurate with the contribution of this sector to GDP. Similarly, the minimum benchmark credit-deposit ratio of 60 per cent needs to be insisted upon for each bank/RRB in every rural district of the country to ensure adequate credit flow to the rural and semi-urban sectors.

Human resources

Much of the RRB staff was recruited during the initial stages and there has been a ban on fresh recruitment since 1992. The staff is getting older whereas the complexities and demands of rural banking now call for more dynamism and youthful talent. Rural banking has emerged as a niche, wherein special skills and sensitivity are required. Therefore, the imposed ban on fresh recruitment should be reviewed at the earliest to enhance and diversify the business of RRBs.

Also, RRBs should be permitted to recruit specialists in the technology and agriculture fields. Similarly, grants/soft loans may be provided for technology so as to enable RRBs to compete with commercial/private banks that invest heavily in technology projects. The technology induction in rural banking would facilitate handling low-value, high-volume business effectively in a more cost-effective manner.

6. Conclusion

To sum up, the mandate for the Regional Rural Banks still is largely relevant. Even 27 years since being instituted, the socio-economic conditions of the majority of the rural population continue to be a cause of concern for policy makers of the country, especially in the post-reforms, WTO-mandated era. We still have more than 200 million people in rural areas who live below the poverty line and for whom banking access is still not a reality and, despite a wide banking network the critical gap in rural credit still exists.

Therefore, the requirement for a strong and flexible structure for rural financial institutions like RRBs in rural and semi-urban segments cannot not be overemphasized. Financial sector reforms without social and rural sensitivity would only aggravate the complexities of agrarian sector reforms, which are yet to take shape. The proposed Farmers Commission and the Vyas Committee constituted by the RBI need to look into these issues comprehensively to strengthen the rural credit-delivery mechanism.