Questioned about measures to rein in the record levels of inflation, the government expresses its helplessness time and again. Inflation is a global phenomenon and has been 'imported' into India, we hear, and the government has no magic wand to make it go away.

The inflation numbers that are flashed on TV screens every Thursday pertain to the wholesale price index (WPI), and the most recent value of this index has crossed 12 per cent. There is an across-the-board price rise seen in all the items that make up the WPI, but it is the sharp increase in the price of the food basket that causes the most pain for the average Indian family. And here too, one item is particularly painful. While cereals, milk and pulses have all risen in price, edible oils have shown the sharpest increase. With India importing around 40 per cent of its requirements of edible oil, this is certainly a case of 'imported' inflation. Indeed, the bill for edible oil imports is nearly half the total spent on importing food items.

If the government is helpless because the inflation is 'imported', the question that arises is - how have we become so largely dependent on imports for an agricultural commodity like edible oil? A look at the policy towards oilseed production of successive governments over the years provides some clues.

The drive for self sufficiency

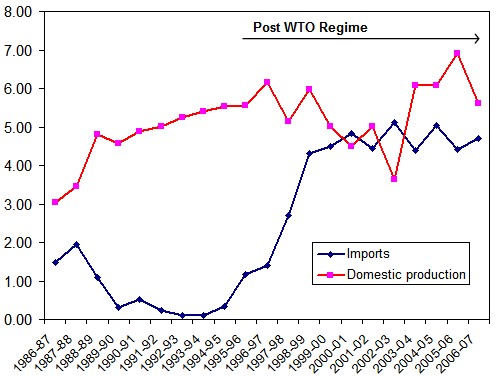

These measures taken together led to a rising edible oil output and most importantly, a remarkable stability in oilseeds and oil production. Edible oil production from primary sources went up to about 5.5 million tonnes in the oil year 1994-95 (November 94 to October 95) from 3 million tonnes in 1986-87; imports came down to negligible levels. India even became a major exporter of oilseed meal and castor oil during this period. Since oilseed crops were mainly grown in rain-fed areas, the focus on oilseeds benefited rain fed area farmers who had been otherwise shut out from the gains of the earlier 'green revolution'.

Domestic oil production (from the 9 primary oilseeds) and imports, in million metric tonnes. Domestic production from secondary sources is not shown.

There were critics of this programme, notable among them being the World Bank. In a 1991 paper the bank argued that the government programme was economically costly, inefficient and unsustainable as production increases had been obtained in an environment where imports were controlled and domestic prices ruled higher than international prices. Its logic was that oilseed production in India did not have a 'comparative advantage' - hence it was better off importing oil and spending its resources in other areas rather than on edible oilseed technology.

After the programme had been in operation for several years, however, the bank came up with a different assessment. In a 1997 report titled The Indian oilseed complex: Capturing market opportunities, the bank considered the programme to be a 'conditional success' and agreed that the technology inputs provided in a protected oilseeds market had indeed resulted in increasing the productivity and improving the cost competitiveness of Indian oilseeds as well as stabilised the production; however it still believed that the government's policy had left consumers in India bearing the cost, in terms of higher domestic prices of edible oil than international prices.

Throwing open the flood gates

In 1994 the government, in a major policy shift, placed certain edible oil imports under the Open General License - which meant that imports could be made freely after paying duty. This was probably in anticipation of the commitments that India had made in GATT (the pre-cursor to the World Trade Organisation) relating to trade in agricultural commodities. Imports started increasing to satisfy some of the demand that could not be met earlier.

The World Trade Organization came into being in 1995 and adopted the agreements that had been reached by GATT members in the Uruguay Round. This included an agreement on agriculture that required reducing barriers to agricultural imports in the decade 1995-2004. As part of its obligations under WTO, the government removed quantitative restrictions on edible oil imports and replaced them with import duties. In succeeding years, even the import duties were lowered rapidly, from 65 per cent in 1994 to 20 per cent in 1996 and 15 per cent in 1998. It must be pointed out that the duties applied by the government in this period were much lower than the upper bounds (300 per cent on crude and refined palm oil and RBD Palmolein, for example) allowed by the WTO regime. The government was not disallowed from levying higher import duties; indeed it was only exercising its policy option by choosing lower import duties.

This lowering of duties combined with a sharp fall in international edible oil prices in 1999 led to a flood of cheap oil being imported into the country, initially in far greater quantity than the requirement. By 1998-99, imports reached the level of 4.3 million tonnes, a ten-fold increase in four years.

One argument advanced in support of the policy of free imports was the benefit that consumers got through low prices and the increase in per-capita consumption of edible oils as a result of the lower prices. However, the flood of cheap imported oil had a disastrous effect on India's edible oil farmers. Oilseed prices crashed and remained depressed for the next 3 years. In 1999, newspapers reported massive distress sales of oilseeds by farmers at prices much below the Minimum Support Price, with the government refraining from market intervention operations.

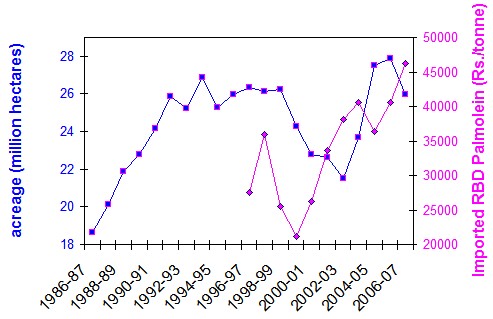

Not getting a remunerative price, farmers responded in the only way they could - by reducing the acreage under oilseeds. Domestic edible oil production from primary oilseeds fell sharply in the period 1996-97 to 2002-03. The edible oil industry in India had come around a full circle from 1994; imports of edible oil were now firmly established and India had become the world's largest importer of edible oil.

Oilseed acreage and price of imported oil.

The graph shows how the acreage under oilseeds is sensitive to the price of imported oil. As cheap imports rose, farmers planted

less in India.

The edible oil policy of the post-WTO period introduced a large element of instability into domestic production by completely exposing it to international price fluctuations. After seeing a continuous increase in acreage up from 18 million hectares in 1986 to 27 million hectares in 1994, the area under oilseeds production has remained around 26-27 million hectares, falling at times of depressed international prices. Productivity of land under oilseeds has also remained stagnant at levels of a decade ago. The OTM became dormant, never recovering from the body blow it suffered from the post-WTO policy regime.

The future shock of bio-diesel

In recent years, the international edible oil markets have come around full circle from the price lows of the year 2000. Indian farmers have not added acreage under oilseeds from the mid nineties because of the unstable market environment and withdrawal of government support. This has lead to a large gap in supply and demand that cannot be bridged quickly. India is in deep trouble now, being dependent on imports for 40 per cent of its requirements at a time of sky-rocketing prices. at a time of sky-rocketing prices. Wholesale prices (of imported RBD Palmolein) have been increasing for the last three years and were 60 per cent above average 2005 prices this July.

The government is importing inflation and there is very little it can do in the short run besides reducing duties to zero per cent (it has already done this). The policy that reportedly favoured Indian consumers at the cost of farmers has come back to bite the consumers with a vengeance.

•

Seeds of hope

•

Green, but risky too

•

Think outside the barrel

The demand for vegetable oil is becoming linked to the price of petroleum and to the geopolitical complexities of the crude petroleum market. The US and European countries are de-risking themselves from high dependence on imported crude petroleum by increasing the use of bio-diesel (made from vegetable oils) as fuel. Governments have started setting targets for petroleum companies for mandatory blending of bio-diesel with petro-diesel and these targets will be increased over time. Bio-diesel adoption and use will also be determined by government subsidies.

The demand and supply equation, and hence the price of edible oils will therefore be subject to the vagaries of government policy of the major petroleum importers, primarily the US and Europe, the international price of crude oil, as well as the requirements of the large edible oil importers like China and India.

In this 'mixed' economy of fuels and food, there is an urgent need for the government to formulate and implement a policy that will cater to the long term interests of Indian farmers as well as edible oil consumers. Indeed, now that 'agriculture' is being defined in the context of fuel as well, there may be some manoeuvring room for India in the trade arena as well. If energy security needs provide justification for the US and Europe to take steps to limit their dependence on imports of crude petroleum oil, can India be faulted if, in the interests of its food security, it takes steps to limit its dependence on imports of edible oil, an essential food item in this country?

•

•