It is curious to think that events this year might have already overtaken raging controversies of very recent vintage. A decade ago in the aftermath of the Gulf War, in his essay 'The Archaeology of the Development Idea', Wolfgang Sachs presciently pointed out that "... the 'development' concept loses its reassuring connotations for the future: slowly it is being substituted by the concept of 'security' - from the North's viewpoint, naturally". While the debate on globalisation took on new meaning in Seattle, in the aftermath of the brutal occupation of Iraq, one could argue that the phase of globalisation as Western hegemony is over and Sachs's prediction has come true - imperialism is back with a vengeance. Nevertheless, globalisation has not disappeared with Baghdad being overrun and its impacts continue to be felt. Globalisation and the nature of the international institutions which implement 'its' policies are of immense interest and ought to be scrutinised since they continue to tremendously affect the lives of millions of people around the world.

Since the inauguration of a new phase of conservative politics and

increased American intervention in world affairs during the Reagan years,

the Bretton Woods triumvirate (i.e. IMF, World Bank and lately the WTO) have had a

steadily increasing role in the devastation of ecologies and economies in

the so-called Third World. In such a context, it is hoped that to public institutions

like the IMF, much used to imperious ways and owing no accountability, Stiglitz

brings more than minor discomfiture when he states in his preface, "I have written

this book because while I was at the World Bank, I saw firsthand the devastating

effect that globalization can have on developing countries, and especially the

poor within these countries."

Since the inauguration of a new phase of conservative politics and

increased American intervention in world affairs during the Reagan years,

the Bretton Woods triumvirate (i.e. IMF, World Bank and lately the WTO) have had a

steadily increasing role in the devastation of ecologies and economies in

the so-called Third World. In such a context, it is hoped that to public institutions

like the IMF, much used to imperious ways and owing no accountability, Stiglitz

brings more than minor discomfiture when he states in his preface, "I have written

this book because while I was at the World Bank, I saw firsthand the devastating

effect that globalization can have on developing countries, and especially the

poor within these countries."

The bulk of the book is a closely argued indictment of the IMF for multiple crimes from a man with a ring-side view of the eventful years that saw the financial meltdown leading to the East Asia crisis of 1997 and the beggaring of Russia. After a short and not very insightful perusal of the origins of the Bretton Woods institutions the author delves into the heart of the major crises of capitalism in recent times mentioned above and shows how the IMF shockingly mismanaged both. From the vantage point of these spectacular failures Stiglitz goes on to discuss the structural problems with global financial governance and the manner in which its institutions are deeply complicit with the agenda of the US Treasury Department and the carpetbaggers of Wall Street.

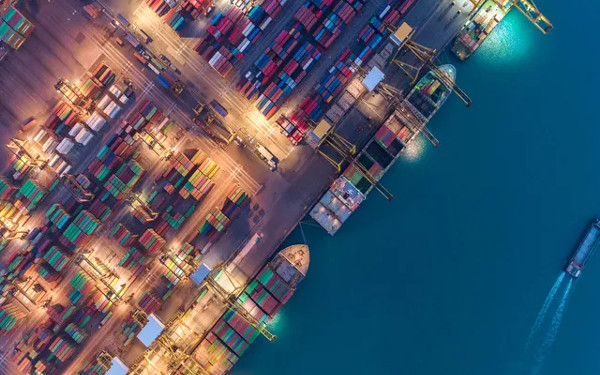

The organisation and reach of global capital and its institutions is so wide-reaching and complex today that most people who are affected by them are scarcely able to comprehend the causal linkages which make policy shifts in far-away capitals to manifest as serious problems in their lives. However people in the poorer parts of the world have intuitively understood the effects of such policy changes dictated by the Washington Consensus, while their protests have been steadily ignored.

But along with this greater pain inflicted on the Third World, a clearer understanding has also emerged. This pain and understanding was given a clear, visible form in the eyes of the entire world when the protests against such institutionalised loot arrived at the American doorstep in Seattle, Washington and elsewhere.

-VG

Throughout the book Stiglitz consistently draws attention to the fact that the IMF is working in a manner that directly contradicts its original mandate of providing economic stability in the times of crises. He also points out the consistent gap between rhetoric and reality and in a larger sense shows how the global public institutions instead of being accountable to the societies they affect often behave as the tools of American capital. In a carefully argued position, he also points out that by forcing nations receiving its money to adopt policies like capital market liberalisation and massive privatisation without bothering to put a social security net and a market regulatory mechanism in place, the IMF is doing immense damage and no good. Moreover its orthodox positions on structural adjustment and laissez-faire where government is intrinsically bad and that the market would solve its own problems is also theoretically incorrect in the light of recent advances in economic understanding.

Having pioneered a shift in the policy of keeping the deficit down at all costs, Keynes had originally intended the IMF as an antidote to global depression by controlling the market with an eye to generating employment and as a short-term manager to prevent a crisis (like the one in East Asia) from coming to a boil. As a means of promoting economic stability Keynes had advocated an expansionary fiscal policy that would help keep the crucial economic indicators of unemployment and inflation within reasonable limits. But instead the IMF consistently violates its original mandate of providing stability by pushing for the complete removal of controls and demanding massive and rapid privatisation. Stiglitz believes that "... capital accounts liberalization was the single most important factor leading to the crisis". But he is also utterly contemptuous of the IMF's broader policies; in discussing the extended period of rapid growth prior to the 1997 crisis (dubbed the East Asian Miracle), he says that "The countries had been successful not only in spite of the fact that they had not followed most of the dictates of the Washington Consensus, but because they had not." (emphasis in original).

Stiglitz explains at length the process of the contagion of recession, the flight of capital and the return of the very same 'hot money' later to make a killing when the local currency was weak. Even the huge bailout packages only helped the large American banks that made the bad loans, to make a tidy profit. The countries that followed the IMF's prescriptions suffered deeply (leading to riots in Indonesia where people saw their savings and jobs wiped out at the same time) but the countries which managed to contain the worst aspects of the crisis and made a quicker recovery are precisely those that ignored the IMF's advice and even went against it. In the face of all evidence pointing to the failure of such measures to ensure stability and a recovery from the depression that countries like South Korea, Thailand and Malaysia had sunk into, the IMF variedly blamed it on the governments and "crony capitalism" and demanded even faster privatisation. It was as if truth and reality were meaningless in the face of IMF's fundamentalist position that the market could never be wrong.

It is rarely recognised that the forced liberalisation of capital markets the world over is made possible only with the development of vast electronic communications networks once again demonstrating that technology is not neutral and value-free but is deeply imbued with the colours of the political economy within which it is developed.

-VG

In such a fluid situation, with no regulatory mechanisms in place, a ruthless mafia economy emerged in Russia and as elsewhere IMF's bailout packages just resulted in the money lent taking flight immediately into the safe havens of the US stock market or off-shore banks; when privatization takes place rapidly with no regulating mechanisms in place it only leads to asset stripping since one could make a quicker buck this way instead of investing and creating goods and assets in an extremely uncertain economy. In Russia, it also led to faking privatisation where government assets (factories etc.) were held as collateral against loans from private banks and then the government conveniently defaulted allowing its friends who owned the private banks to take-over the assets. Given the highly illegal nature of the whole deal, the new owner was not interested in retaining his ill-gotten wealth in Russia but spirited it out of the country. Amidst all this, the decision to bailout and fatten Yeltsin's cronies was based on the political judgment of the Clinton administration and not on economic sense.

Stiglitz also clearly states that the textbook economic models, by themselves simplistic are even more flawed in dealing with 'dynamic' situations, i.e. they completely fail to account for events in economies making major transitions, like Russia's experience of moving from communism to a market-based economy. The IMF's insistence on capital market liberalisation (come what may) and curbing the deficit etc. contributes to a contractionary fiscal policy, the opposite of an expansionist policy advocated by economists for over 60 years and the one that China followed effectively during the Asian crisis. For Stiglitz, China's example of prudent management is instructive; it did not follow the IMF's advice and paced and sequenced its economic changes carefully before cautiously opening its market, thus avoiding the many pitfalls that many Indian policy experts and investors are asking our Government to ignore, all in the name of a "free market".

In all this, Stiglitz emphasises the unholy nexus between the IMF, the US Treasury Department and Wall Street but fights shy of reading a conspiracy into it. Instead he states, "I believe that there is a simpler set of explanations - the IMF was not participating in a conspiracy, but it was reflecting the interests and the ideology of the Western financial community." But not only did the IMF's policies devastate many economies and leave them vulnerable to more arm-twisting (as Stiglitz himself diligently catalogs), it also lead to extreme social strife due to the sudden loss of jobs as a result of massive privatisation. As Stiglitz himself recognises, when such crises lead to food riots and general social instability (as in Indonesia), the economy is bound to suffer even more. These facts and that the IMF consistently worked in tandem with the US Treasury and pushed for untenable fiscal measures puts into doubt the very idea that there wasn't a 'conspiracy' to do so. Claiming that the IMF was somehow 'reflecting' other people's ideology and interests is too naive an explanation to be taken seriously.

Apart from a clearer perspective on why the IMF's policies were bound to fail, it is also instructive for India to examine what Stiglitz has to say with regard to the general debates on the opening and regulation of international trade, privatisation, the role of Government and the duplicity of the powerful. Stiglitz is not against the concept of "one world", rather he wants an increasingly integrated world that is fairer and more just; and wants a reworking of global institutions to reflect this need for "decency and social justice" and also that both market and government have a role to play. While he "... believe(s) that globalisation - the removal of barriers to free trade and the closer integration of national economies - can be a force for good and that it has the potential to enrich everyone in the world, particularly the poor" (an extremely doctrinaire and dubious view by itself), he is also of the opinion that "the way globalization has been managed ... needs to be radically rethought."

With hardly a credible debate on the rationale and justification of rapid disinvestment, some of the most profitable or strategically important public sector undertakings are being privatised. Even in the case of loss-making units, privatisation is being posed as the only restructuring alternative, as a result of which private investors who have done nothing to develop the infrastructure are allowed to step in to reap the harvest of profits.

Apart from being undemocratic and lacking due process and accountability, the relinquishment of Government control of significant parts of core sectors like petroleum and electronic communications has serious social implications, especially in our society where the huge inequities necessarily means that the Government has a social role to perform.

-VG

Stiglitz's views on global trade are bold and strikingly honest, "Today, few - apart from those with vested interests who benefit from keeping out the goods produced by the poor countries - defend the hypocrisy of pretending to help developing countries by forcing them to open up their markets to the goods of the advanced industrial countries while keeping their own markets protected, policies that make the rich richer and the poor more impoverished - and increasingly angry."

Inspite of his belief in the ability of globalisation to do good, Stiglitz's arguments and statements run quite close to those of anti-globalisation activists; the reason being that both are looking at the evidence on hand which is not a pretty sight to behold. However a discussion of globalisation as a purely economic phenomenon to do with markets and fiscal policy is misplaced and may even be misleading.

Current-day globalisation must be seen as a continuation of colonial policies, albeit under altered conditions. Today, the enterprise of spreading the gospel of free markets is predicated on the iron fist of overwhelming American military power. The fact that there might be political consensus (as is the case with most political parties in India) in favour of the very same market-friendly policies does not in any manner alter the fact that the steam-rolling of national economies into a single pattern is backed up at the most fundamental level by the threat and coercive power of military dominance. As an advocate for freewheeling capitalism himself admits, "The hidden hand of the market will never work without a hidden fist, McDonald's cannot flourish without McDonnell Douglas. And the hidden fist that keeps the world safe for Silicon Valley's technologies to flourish is called the U.S. Army, Air Force, Navy and Marine Corps." (Thomas Freidman, Lexus and the Olive Tree).

In this account while Stiglitz leaves the WTO largely undiscussed, the IMF is made out to be the evil twin to a World Bank that is becoming more open, democratic and non-doctrinaire. Stiglitz's coyness in spilling the beans on his former employer is quite misleading and gives the impression that the Bank is fundamentally different and almost humane in its approach. While perhaps one could argue that the World Bank is less destructive compared to the IMF, I believe that is not attributable to differences in policy and practice but in the sheer difference of power in their spheres of influence. The impacts of development projects are slow to accrue and often their worst impact is felt in the poorest segment of a society (say, when you build a dam) and invariably there is strong political consensus in that society for such 'developmental projects' For example, while displacement without adequate compensation has been ugly norm for dam-building in India since the times of Bhakra, it is only with the Narmada protests has the problem come to the fore in the public imagination.

In contrast, the sting of the IMF's ministrations is palpably immediate as it sends a shock wave through the economy and within a very short period of time, wreaks havoc. However, no one can deny that the cumulative effects of the obsession with a certain notion of development and often a wilful disregard for basic environmental norms and human rights leads to the extreme privations of 'ecological refugees' from the multitude of projects funded by the Bank. All of this is lucidly, if painfully, laid out in Bruce Rich's ' Mortgaging the Earth' and Catherine Caufield's 'Masters of Illusion'. Moreover, today the World Bank is working closely with the IMF and the WTO for greater synergy which does not bode well for the developing world. It is also the case that the Bank itself has close linkages with the US Treasury - as exemplified by the infamous doctoring of the World Development Report by the US Treasury. Stiglitz mentions the Ravi Kanbur report, but is surprisingly silent about how it was blatantly manipulated.

Whether global public financial institutions like the IMF, the World Bank and WTO can be made more accountable to the people of the world and be more responsive to their needs is a debatable question. And short of a miracle (or a greater catastrophe overtaking us), the protests and struggles against the depredations of global capital will continue for the poor of the world have no other choice but to defend themselves. Stiglitz's ability to be honest in his assessment and relatively free of prejudice makes his critique invaluable and well-worth recommending to all who are interested in the larger debates on liberalisation and the process of 'reforms' which in India has become a byword for shutting out all honest debate. Such a clear-eyed perspective as offered by a leading economist is refreshing, welcome and must surely add to the voice of activists and advocacy groups around the world. For taking on the difficult task of looking within and making an honest appraisal, Joseph Stiglitz must be congratulated even if one cannot agree with all that he says.