Every time you drive your vehicle, or take a taxi or an auto, you are likely adding a few rupees every kilometre of your ride to the Center and State's tax kitty by way of multiple taxes and cess on petrol and diesel. Now imagine, 1.3 billion people who do this every day, traveling a cumulative of billions of kilometres – contributing close to Rs. 5,00,000 crores of revenue to the Centre and State Governments in 2019-2020.

These revenue numbers are from only the petrol and diesel fuel taxes. The royalties and dividends from state coal, and fossil-fuel based energy companies add further important revenues to the exchequer. With the increasing penetration of renewable energy, and the electric and non-fossil fuel based transition that has started in transportation both in India and globally, the impact on these tax revenues becomes a very important and pertinent issue to be addressed.

The Energy Group at Prayas Pune has published a timely and well-researched white paper on taxes in the energy transition in India. A webinar with experts who have a deep understanding of the states' and Centre's finances and economic planning was organized as part of the Girish Pant Memorial Annual Event on 10 February 2021. This article captures some of the key discussion points and insights from the report and the webinar.

A changing landscape for energy

The Indian energy sector is undergoing a slow but steady transition to renewable sources of power. Over the past three years, renewable energy installations have far outstripped coal-based power installations. The rapid decrease in the price, coupled with the increased financing available for sustainable sources of power, has powered the increased penetration of renewable power in the Indian grid. This transition will produce winners and losers if not managed properly - those involved with the traditional sources of power will lose out in the transition, and those in the 'new' energy sector that will also power new models in transportation and mobility will win.

The potential solutions to support the transition are further complicated by three factors. One, in the poorer parts of the country, many jobs are dependent on fossil-fuel based energy sources, and there could be political implications from job losses there. Second, there is also significant public sector / government ownership in old energy, and a lot less in the emerging alternatives. The Center and States are both involved with old energy businesses, and revenues to the governments from these are also significant. Third, electricity is in the Concurrent List of the Constitution of India, and this could create unique challenges to the reforms proposed in the sector

Energy income for the government

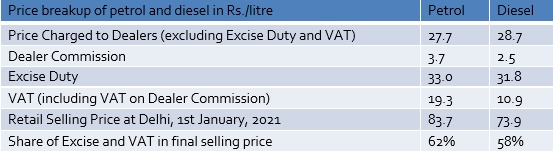

The Prayas report is based on detailed analysis of the taxes and other sources of revenue to the government. As an example, in the state of Delhi, during January 2021, before petrol prices rose to historic levels, various taxes and cesses constituted roughly 60 per cent of the sale price (see Table below).

A quick look at the contribution of the various revenues from fossil-fuel based sources for the past two fiscal years shows that the Center and State Governments each get about half of these funds. But the Centre's dependence of these funds is higher; in 2019-20, about 25 per cent of all Central Government tax revenues came from the energy sector, whereas for the states the corresponding figure was lower, at 13 per cent.

Of the energy revenues, the Central Government revenues were almost entirely made up of taxes on petroleum products and coal while for states, electricity-related revenues made up 18 per cent of all energy revenues, still a relatively small amount. The ability to increase electricity revenues is impacted by the high levels of electricity subsidies provided to large number of users as well as losses due to theft. In the coal-rich states, energy royalties form a large part of the revenues, compared to the revenues from consumption.

Implications of the energy taxes on EV operating costs

Assuming petrol or diesel mileage of 15 km/litre, the taxes equate to about Rs 3.5/km run by a vehicle. If one were to assume that an average electric vehicle operates at 4 km/kwhr, then the additional taxes/cess on electricity to maintain equivalency on a per-km basis would be roughly Rs 14/kwhr over and above the current electricity price. This would obviously make the economics of using an electric vehicle unviable in the short-to-medium term, which in turn will reduce the rate of adoption of EVs.

The assumption in this argument is that the energy taxes on petrol / diesel would be entirely substituted by taxes on electricity used for transportation alone. Since implementing such a scheme is impractical, a broader view of expanding the tax base will need to be taken. More comprehensive reform is needed in the tax system in order to ensure that the more environmentally sustainable alternative for transportation can be adopted faster, and the threat of lower tax revenues does not become an obstacle to this transition.

Comparison with global economies

Most advanced economies depend very little on energy taxes for their revenues, and governments rely more on personal and value added taxes. India, however, is still significantly dependent on energy taxes, with some states being much more heavily dependent than others. India's tax-to-GDP ratio stands at around 10 per cent, compared to the average of about 34 per cent in OECD countries. This highlights the narrow tax base that the Indian tax administrator has to work with, and therefore the limited options to accept a reduction of fossil-fuel based taxes till the tax base is much broader.

Key insights from the webinar

Prayas also organized a webinar with four very knowledgeable panelists - Dr. M Govinda Rao, an renowned expert in Public Finance over several decades, T K Arun, Consulting Editor at The Economic Times, Rahul Renavikar, the MD of Acuris Advisors, a business advisory company; and Dr. R Kavita Rao, a professor at the National Institute of Public Finance and Policy. Over the course of the discussion, the panel stressed the following points.

The discussion around bringing petroleum products under the GST regime has been ongoing for a few years. Recently, key opinion makers in the policy framework such as the Petroleum Minister and Chief Economic Advisor of India who have also voiced their support for bringing petroleum and petroleum products under the GST regime.

A small portion of the petroleum value chain is subject to GST, but most of it is not. This is largely due to the significant cascading taxes that, if set-off were provided for, would reduce the tax revenues for the government. It also reduces the ability of state governments to set the tax rates on an important consumption commodity, without which they would be entirely dependent on sharing of revenues with the Central Government on rates established uniformly across the country.

Under a GST regime, petrol would cost around Rs.75/litre, and diesel Rs.68/litre. Under a GST regime, petrol would cost around Rs.75/litre, and diesel Rs.68/litre. |

Electricity being a Concurrent subject in the Constitution, it is outside the ambit of the GST Council, and significant changes will require a constitutional amendment. Electricity is also used as a tool of policy by governments to cross-subsidise some users (low income groups, important industries, farm sector, etc) using revenues levied on commercial and industrial users, as well as metered retail users. The State Governments impose taxes on electricity, but the Central Government's loss of revenue from fossil taxes would have to be compensated in some other way. The panelists agreed that GST and the electricity subsidy regime need to be looked at together to find the way forward.

In light of the current lower trust in the GST due payment from the Centre to the States, and a reduced capacity by the state governments to raise taxes have political implications that go to the root of the federal structure of Indian democracy.

It is quite evident that most advanced economies have moved away from energy subsidies and taxation as the carrot-and-stick policy of revenue balancing of their budgets. India too needs to be moving in that direction. However, in the current scenario, with the Indian economy just starting to recover from the twin challenges of the default shocks in the financing sector (NPAs, liquidity crunch and weak bank balance-sheets), and COVID-related economic consequences, the options for immediate action are limited, and may not be very effective either.

Reducing the cost of petroleum and diesel products by rationalizing the tax rates would reduce the operating advantage of EVs over diesel/petrol vehicles in the short term, in addition to reducing the Government's revenues. There was consensus in the panel that to make manufacturing and the Indian economy more competitive, it is imperative to reduce energy input costs. To compensate for the loss in revenue, the significant tax exemptions that have been provided on downstream transportation revenues - such as bus and train tickets - from the use of petroleum products also have to be removed.

A recent study by economists at SBI Research outlined a few scenarios if the entire value chain of petroleum products were brought under GST. It estimated that bringing them under the GST regime at a 28% rate would potentially reduce the prices of the petrol to about Rs 75/ litre and diesel at about Rs 68/ litre. This would be inclusive of transportation costs, dealer margins, and cesses of about 30 Rs/ litre for petrol and 28 Rs/ litre for diesel. The price elasticity assumes that the consumption for petrol goes up by 15% and by 10% for diesel at these prices. The SBI Research report estimates that with these assumptions, the tax revenues would reduce by as much as Rs 1,00,000 crores (0.4% of GDP), with the States being the biggest losers of revenues, and therefore need to be compensated.

On the positive side, reducing the cess and taxes on petrol and diesel would reduce the equivalent taxes that need to be applied on electricity to make up for losses in the short to medium term – to as low as 4-5 Rs/ kwhr over the current price.

Complexity

The combination of subsidies in energy supply and high tax revenues make the reforms implementation in the tax regime much more inter-dependent and complex. That said, since the renewable energy penetration is still small, and EV adoption is relatively very nascent, this is the most appropriate time to create the new ways for augmenting revenues from non-energy sources.

|

Energy sources including electricity are a key input cost for various economic activities, and keeping their costs high has a significant downstream effect in the competitiveness of Indian Industry. The Government is keen to see Make-In-India become a viable strategy for manufacturers, and reducing input energy costs will have a significant effect on the attractiveness of the market. Increasing taxes on electricity has to also be pursued carefully, since the supply of electricity is still not fully reliable across the country, and most industries have found the need to maintain diesel backups to ensure continuity of operations during frequent electricity outages. At the same time, it is important for the government to continue to pushing towards an environmentally sustainable economy, and ensure there is sufficient factoring in of environmental costs into the fossil-fuel based energy sources.

In the short–to-medium term, the states that benefit from mineral extraction royalties can expect to see a longer transition than those dependent most on taxing the consumption of the petroleum and diesel products, as the overall EV adoption will also increase the demand for base-load electricity.

While some sort of support for the lost revenues is required in the short term, it is also important to ensure that the transition to new energy sources does not result in permanent subsidies that cannot be supported as cleaner energy becomes the norm in the medium-to-long term. The challenges of planning for a transition whose rate of adoption and acceleration are unknown today was also discussed, underscoring the need for a proactive and dynamic response rather than a formulaic approach, while keeping the competitiveness of the economy in mind. One panelist felt particularly strongly that the planning and execution for diversification of the State and Centre's revenues away from fossil fuel taxes should ideally be undertaken by an expert committee set up by Parliament, and not by a Finance Commission.

Conclusions

Against the back-drop of the energy and mobility transition, it is clear that a significant move away from fossil fuels for transportation and power generation would impact the Center and State Governments' tax revenues is a very material manner. While it will be at least 5-7 years before the impact is substantial, it is imperative that various stakeholders start working on the necessary reforms that will ultimately result in an overall tax revenue neutral framework by increasing the dependency on income taxes rather than energy taxes for a substantial portion of the country’s tax base.

The policy regime will also need to take up comprehensive reform of the tax and GST structures to ensure that increasing adoption of renewable energy and electric vehicles is encouraged to avoid environmental damage, but does not erode the tax base too quickly or without the necessary diversification from energy taxes in the government's revenues.

The consensus of the panel was that there are tools available today at the disposal of the Government to use data from the GST collections and tax filings to plug the gaps and augment revenues from non-fossil-fuel sources. Only this can systematically move the country away from its reliance on energy taxes for a significant part of its revenues, while propelling the Indian industry to be more competitive, and play a key role in the most significant energy-mobility transition in over a century.