HIGHLIGHTS OF THE BILL

(Read this section in detail)

-

The Pension Fund Regulatory and Development Authority Bill, 2005 establishes an authority to develop and regulate the new pension system (NPS) which seeks to provide old age income security for all individuals, including those in the unorganised sector.

-

This page is organised as follows: The highlights of the Bill and the key issues to be considered are listed briefly first; the details of each are presented thereafter. Click here to see the highlights in details, and here to see the detailed analysis of key issues.

• Seniors await policy, action

• Older women in the city

• Covering the silent revolution NPS will be implemented through a combination of retailers, pension funds and recordkeeper(s).

NPS will be implemented through a combination of retailers, pension funds and recordkeeper(s).

-

Every subscriber will have an individual pension account, which will be portable across job changes. The subscriber will choose the fund managers and schemes to manage his pension wealth. He also has the option of switching schemes and funds.

-

The NPS has already been operationalised for new central government employees through a notification. This is a 'defined contribution' scheme unlike the 'defined benefit' scheme for existing central government employees.

KEY ISSUES AND ANALYSIS

(Read this section in detail)

-

The Bill provides a structure to the private and unorganised sectors to plan for old age income security. It is not compulsory for these sectors to take part in this system. Those not participating may still have to fall back on public resources in old age.

-

In the system for new government employees, the investment risk is entirely borne by the employee. However, he is no longer exposed to the risk of default by the government.

-

There will be no explicit or implicit guarantee on the pension wealth unless through purchase of market based guarantees. This is unlike the case of bank deposits where deposits up to Rs 1 lakh are guaranteed.

-

Any unfavourable event affecting market prices at the time of retirement could lower both pension wealth and the annuity rate. Subscribers may have to stay on in the system beyond their retirement date in order to ride over such a shock.

-

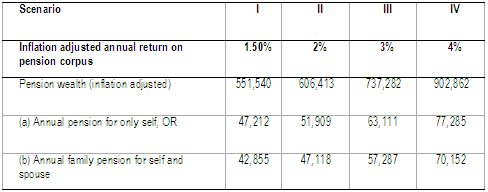

Parliamentary Research Service (PRS) estimates that given current market rates for annuity, Rs 1,000 per month subscribed to NPS for 35 years will result in lifetime annual pension for self of Rs 47,000 to Rs 77,000 under different scenarios of returns.

Context

This Bill sets a framework for the development and regulation of pension funds in India in order to promote old age income security. It defines an architecture consisting of retailers, pension funds and record-keeper(s), and establishes a statutory body to regulate the sector. The pension scheme for new government employees has been changed from the existing defined benefits (DB) system to a defined contribution (DC) system. That is, the pension payable at the time of retirement is not fixed on the basis of the pay-scale (DB) but will be determined by the funds accumulated through contribution and investment gains during the service of the employee (DC). This new system will be governed by the architecture proposed in this Bill.

Only 13% of the workforce is currently covered by pension schemes. These are government employees and those in the organised sector covered by the Employees Pension Scheme 1995. Schemes offered by insurance companies and regulated by the Insurance Regulatory and Development Authority (IRDA) are also available, but these are a combination of pension and insurance. This Bill provides a regulatory framework for a new pension system (NPS) which will be available to any individual.

High budget deficits have reduced the government's ability to continue the current system. A number of state governments have reportedly delayed pension payments. Total government (centre+states) pension cost has increased from Rs 6,400 crore in 1991 to Rs 46,569 crore in 2001, which is a growth from 7.3% to 14.6% of total tax revenue. An estimate suggests that the implicit pension debt of centre and states on account of pension liabilities to current employees is 55% of GDP. The NPS tries to address these issues. The central government has implemented NPS for its employees appointed from January 1, 2004 through a notification issued in December 2003. Currently, all the contributions in this scheme are being parked in the Public Account, and the government is paying interest at 8% p.a. These funds will be moved to schemes managed by Pension Fund Managers after implementation of this Act.

Key features

The Bill is in the nature of an enabling legislation. It establishes the Pension Fund Development and Regulatory Authority (PFRDA), defines its powers and duties, and sets the broad contours of NPS. The particulars of NPS (such as selection of intermediaries, types of schemes etc) are not detailed, and shall be determined by PFRDA through regulations.

-

The New Pension System (NPS)

The system comprises one (or more) central recordkeeping agency (CRA), a set of pension fund managers (PFMs) and point-of-presence agencies (PoPs).

The CRA shall maintain records, accounts and effect all instructions regarding subscription, switching of options and withdrawals by the subscriber. The subscriber may access the CRA directly for information.

The PFMs shall provide a set of schemes with varying risk-return profiles (i.e., balance between risk taken and returns expected), and manage the assets of subscribers.

The PoPs shall receive instructions and contributions from subscribers, transmit these to the CRA, and pay out benefits to the subscribers. They will be the 'windows' for subscribers to the system.

Every subscriber shall have an individual pension account (IPA). He has the option of selecting the PFMs and schemes. He can switch his funds across PFMs and schemes.

The IPA will be portable in case of change of employment. (As in the case of a bank account, the IPA is independent of employment details). The subscriber cannot exit from the system except as specified by notification by the central government. The current notification specifies two options. (a) If the subscriber chooses to exit at the normal age of retirement (60 years), he shall use at least 40% of accumulated pension wealth to purchase an annuity from a life insurance company. This annuity will provide pension for the lifetime of the employee, his dependent parents and spouse. (b) If the subscriber chooses to exit the scheme any time prior to retirement, the minimum amount to be converted as an annuity is 80% of the accumulated pension wealth.

The notification mentions a two tier structure for government employees. Tier-I will be the core level with the employee and the government each contributing 10% of basic+DA, and there will be no withdrawals till exit. The employee can opt to contribute a further amount into a withdrawable Tier-II account, which will not have any contribution by the government.

-

Establishment, powers and duties of the PFRDA

The PFRDA shall regulate the NPS and other pension schemes under its purview. It will register and regulate all intermediaries including CRAs, PFMs and PoPs. It shall be responsible for protecting the interests of subscribers and establishing a mechanism for redressal of their grievances. It will approve the schemes and norms (including investment guidelines) for management of the investments by PFMs. It shall standardise dissemination of information about performance of pension funds and performance benchmarks.

The PFRDA comprising a Chairman and up to five members shall be appointed by the central government for a five year term, and may be removed from office only under specified conditions.

-

Scope of the Bill

The Bill does not cover any scheme or funds under the Coal Mines Provident Fund and Miscellaneous Provisions Act 1948, the Employees' Provident Funds and Miscellaneous Provisions Act 1952, the Seamen's Provident Fund Act 1966, the Assam Tea Plantations Provident Fund and Pension Fund Scheme Act 1955, and the Jammu and Kashmir Employees' Provident Funds Act 1961, or contracts covered by the Insurance Act 1938. It also exempts employees of central government and All-India Services appointed before January 1, 2004. Any person governed by any of these exempt schemes may voluntarily choose to join NPS in addition to their mandatory cover.

NPS is mandatory for central government employees who have been appointed from January 1, 2004. It permits state governments and union territories to extend the NPS to their employees. Thirteen state governments have notified NPS for their employees.

The NPS architecture

PART B: KEY ISSUES AND ANALYSIS

-

Existing System versus the NPS

Currently, pension schemes are available to employees of central and state governments. Employees in the organized sector subscribing to the Employee Pension Scheme also have a pension facility.

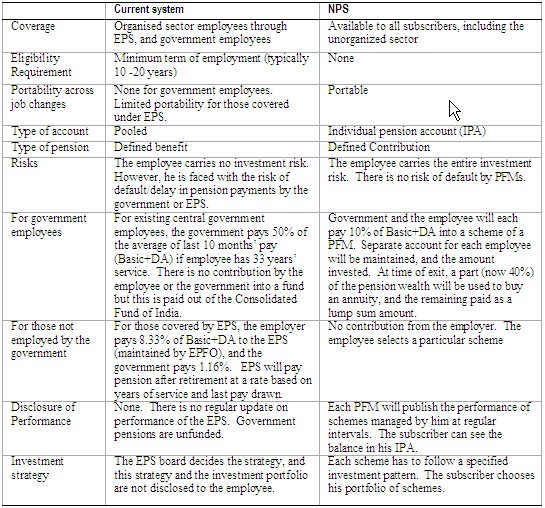

Table 1: Comparison of existing scheme and NPS

-

The Role of PFRDA

The Bill defines the basic structure of NPS and leaves it to the PFRDA to specify details. This will permit the system to evolve with time. Critics argue that given the significant power vested in PFRDA, the selection and appointment of suitable persons to the Authority is critical to the success of the sector. The central government shall make this appointment (and does not need to consult the opposition). This appointment rule is similar to that of the top management of regulators such as RBI, SEBI and IRDA.

-

Defined Benefit versus Defined Contribution

The defined benefit (DB) system, currently applicable to government servants appointed before 2004, and to EPS, promises a fixed amount to be paid per month as pension. This amount is linked to the pay drawn, number of years of service etc., and has no direct linkage to the contribution of the employee or employer towards a pension fund. Thus, the employee faces no direct risk, and the entire investment risk is borne by the pension fund manager and the government. However, the employee is exposed to the risk that the total benefits liable from the pension scheme manager is higher than the funds available, which can lead to delays and defaults. EPS was reportedly underfunded to the extent of Rs 22,000 crore as on March 31, 2004. Even in cases where the benefits are paid out by the exchequer, limited resources can lead to delays, as witnessed by pensioners of several state governments.

In the defined contribution (DC) system as proposed in the NPS, each employee (and his employer in the case of government servants appointed since 2004) contributes a proportion of his monthly income to an individual account. This account is invested in one or more schemes offered by pension fund(s). The balance in the account belongs to the employee, which will be accessible at the time of exit. The employee bears the entire investment risk. However, there is no risk of default by the fund as the liability of the fund to its subscriber equals the assets owned by it.

Traditionally, a large proportion of pension funds around the world have been of the DB type. However, many of these have been under funded, and some have collapsed. This has led to a debate in a number of countries regarding the sustainability of their pension and social security systems.

Table 2: Defined Benefits versus Defined Contributions.

-

Risks

Under the NPS, PFMs will offer an array of schemes (the current notification specifies 3 types) offering differing risk-return profiles. The Standing Committee has recommended that at least one scheme should be fully invested in government securities. The subscriber divides his contribution (as well as existing pension wealth) into these schemes, and has the option of changing this combination at any time. The final pension wealth will depend on the performance of the schemes chosen by the subscriber. Thus, the subscriber takes the entire investment risk. The premise is that fluctuations in market value would smooth out over the working life of the subscriber.

However, the subscriber is exposed to two major risks at the time of exit. If there is a major market shock at the time of retirement (say, an incident such as the attack on Parliament on December 13, 2001), leading to a fall in asset prices, the entire accumulated wealth is at risk. A subscriber with a few years to exit would likely ride over this shock but a subscriber retiring at that time will be affected adversely. Second, the subscriber has to purchase an annuity at the time of exit, and is similarly exposed to any sharp downturn in the annuity market at that time.

The Bill states that there will not be any explicit or implicit assurance of benefits except market based guarantees to be purchased by the subscriber. This rule is different from the case of bank deposits, where deposits up to Rs 1 lakh are guaranteed by the Deposit Insurance and Credit Guarantee Corporation.

-

Coverage

Employees of central government and those in the organised sector covered by EPS:

The Bill excludes employees of central government who joined before January 1, 2004. Those who joined from this date have to be part of NPS. State governments may mandate NPS for their employees by issuing a notification. The Bill excludes all schemes covered by EPF Act. Thus, employees covered by the EPS are exempt from the provisions of this Bill. However, any employee in the excluded category can opt to join the NPS in addition to his mandatory cover.

New government employees will have to contribute 10% of their Basic+DA to the NPS. Thus, their disposable income will be lower than that of those who joined before 2004. Some critics contend that their salaries were determined by the fifth pay commission which took account of pension benefits. They say that withdrawal of such benefits should be compensated by the government. They also claim that the government used up the funds in the former contributory provident fund scheme, and that is the reason for the fiscal stress. However, others challenge this view and state that terms of employment of existing employees have not been changed. New recruits joined service with full knowledge of their salary package, including the NPS, and have no case to complain.

Unorganised sector and others not currently covered

The Bill makes the NPS available to the unorganized sector. However, there is no compulsion to join the system. Many countries (e.g., the social security system in the US) require a mandatory contribution from individuals to ensure that they have old age social and income security.

-

Financial implications

Government finances

The NPS is mandatory for government employees appointed since January 1, 2004. Most of these employees will retire about 30-35 years from now. During this period, the government will continue to pay pension to retiring employees under the old regime as a DB plan. The government will also contribute 10% of the Basic+DA of new government employees to the DC plan. Thus, the actual costs to the government will rise. This will reverse as the proportion of new employees among pensioners rises.

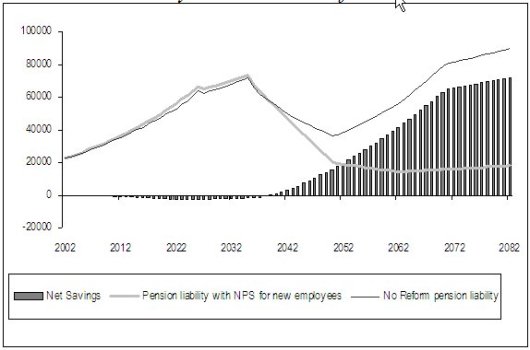

Projected pension cost of central government: Gains under new system will occur from year 2038-39. Computations presented to the Standing Committee suggest that the incremental cost to the government will peak at Rs 2,900 crore in 2021-22, and then decline. Savings will be apparent after 2038-39, and will rise from Rs 1,000 crore in 2039-40 to Rs 37,000 crore in 2059-60 and Rs 72,000 crore in 2081-82. However, these estimates must be viewed with caution as they make several simplifying assumptions owing to lack of detailed data. These include assumptions about age profile of existing pensioners and serving employees, downsizing central government employment, gender profiles etc.

[Source: 21st Report of Standing Committee on Finance on PFRDA Bill 2005, which quotes the High Level Expert Group (Chairman: BK Bhattacharya)].Pension expectations under NPS

Under differing scenarios of return, PRS has estimated the likely annual pension if Rs 1000 is invested in a subscriber's IPA for 35 years. PRS assumes that the entire pension wealth will be converted to an annuity and the annuity rates at that time will be the same as currently available. PRS cautions that the actual annuity could be lower if the average life expectancy increases over the next 35 years, leading to lower annuity rates.

Table 3. Estimated pension per Rs 1000 invested per month in an IPA for 35 years.

Notes: (1) The return has been assumed to be net of inflation, and at a constant rate throughout the period. (2) The entire pension wealth at the time of retirement (age 60 years) is invested in an annuity. (3) Life annuity currently offered by LIC is 8560 per lakh for self and Rs 7770 for self and spouse (in which spouse will get 50% of the amount as annuity after death of self). (4) The assumption of flat contribution are simplistic, as the monthly investments would typically rise with wage growth. (5) The annuity is NOT inflation adjusted after its first year. Source: PRS estimates.