Many find it amusing that it took officials 11 months to declare a "recession" in the United States. Yet, it took more than 20 years to recognise worse. When does a crisis become "A Crisis?" First came ?the boom' - exploding debt, crazy credit, insane speculation, a finance sector gone berserk even as manufacturing declined. Then the doom - as multiple bubbles burst. Massive job losses, a credit crunch, a huge breakdown. These are some features of the ?Crisis' that has struck the U.S. since September.

But some of those problems, certainly ruin of industry and job losses, have plagued other, poorer nations for close to two decades now. Some even saw doom without a boom. When imposed on those societies we didn't call these problems a crisis. We called them "reforms." Or the painful fallout of necessary "adjustment." When they come home to roost in Wall Street, we call it a crisis. Simply put, a crisis becomes a crisis when it hits the suits. Even within those nations on which it was imposed, the poor and hungry were devastated years before the well-off found crisis on their menu. Indeed, the predicament faced by poor people translated into the "success stories" of those elites.

Remember The Crisis that struck India in 1991? The then Finance Minister, a Dr. M. Singh, told us that our balance of payments problem and shrinking forex reserves were truly a crisis. These, he said, called for reforms on a war footing. Oddly, 400 million human beings going to bed hungry every night was never thought of as a crisis. Certainly not one to be dealt with on a war footing.

Within India, rural despair and breakdown meant little. Crisis is when the Sensex tanks. It took over a decade of intense misery before a Prime Minister figured out there were problems in the countryside. Which he then tried tackling with makeshift "relief packages" thinly spread out across hundreds of millions of people. (Even the much-needed NREGA only happened due to arm-twisting allies.) But much larger "stimulus" packages, aimed mostly at the narrow corporate world, happen in a jiffy. And Finance Ministers are quick to descend on Dalal Street within hours of a hiccup on the Sensex. They do so, as the media tenderly put it, "to soothe the market's nerves." Recall the short eight-day session of Parliament in 2004? It followed the historic elections of that year. The then Finance Minister was absent on the first day of that session. He was consoling the distraught millionaires of Dalal Street. The delicate sentiment of the Market had been wounded by the democratic sentiments of the Indian voter.

Even today, debate on the ?crisis' in the U.S. centres around how to help the banks and other financial bodies back on their feet. And that with few preconditions or questions asked. Forays into the most painful part of it - the staggering job losses - are infrequent. These are often mentioned in news items, and now form the rationale for the American Recovery & Reinvestment Act. But it is still very hard to push through the modest measures to help those crushed by the crisis - despite popular support for it. In any case, the jobs crisis never gets the priority that Wall Street's does.

Since the meltdown began in September, the U.S. economy has seen the loss, on average, of around 17,000 jobs a day. Move the baseline to November 1 and job losses have averaged more than 19,000 a day. And the trend is getting worse. Close to 2.6 million jobs have been lost since just September. Over 1.7 million of those have vanished over the last three months. January saw the loss, on average, of more than 800 jobs every hour.

'Understated'

Paul Craig Roberts, who was Assistant Secretary of the Treasury in the Reagan White House, notes that even these numbers "are likely understated." Writing in Counterpunch.org, Mr. Roberts sums up the message of those who use un-massaged job loss data: If we revert to the methodology used in the U.S. in 1980 - before the government started fiddling definitions of joblessness - the U.S. unemployment rate would be not 7.2 per cent but 17.5 per cent.

In India, too, job losses are now finding some mention. When covered in the media, it's mostly about jobs in the IT sector. Or those lost in related fields in the organised sector. While these are not small, only a handful of reports look at the awful hit taken, for instance, by migrant labourers. Millions of these are people who left their villages seeking work when there was no other option. They found it in construction, in laying roads and other poorly paid work. And, keeping afloat in oppressive conditions, many still managed to send something back to their families. Now, as one of them told us: "There is nothing to send back to the village and nothing to go back to the village for." And what about all those small farmers who moved towards growing cash crops for export markets that have collapsed? And do we get to ask questions of the policy experts who brought it all to this point?

Somewhere in there persists a fond and smug belief that our innate cleverness has saved India from all those bad things out there. "What slowdown?" crowed one daily, pointing to the sums spent at IPL's "auctions." If our barons could spend millions of dollars acquiring a clutch of foreign cricketers, it reasoned, things couldn't be so bad. Never mind that some of the franchisees may have laid off lots of workers, and slashed the salaries of many others. Spending three million dollars on just a couple of players is worth seeing in that context, but it won't be. Some sections of the media celebrating the IPL's success as proof of the economy's vibrancy are themselves laying off many journalists and other workers.

But our elite believe that CEOs lead or should lead a charmed life. Remember their outrage when Prime Minister Manmohan Singh - otherwise a darling of the corporate media - made a few bleats of protest about CEO salaries getting, er, a wee bit too large? That other media icon, Dr. Narayana Murthy of Infosys was not spared either when he called for some restraint in CEO feeding frenzy. "Pay peanuts, get monkeys" spat one contemptuous editorial. (Never mind that such publications have paid gold and got gorillas.) Now there is coverage, without much comment, of the bumbling efforts at curbing CEO pay in the U.S.

Corporate kleptocracy

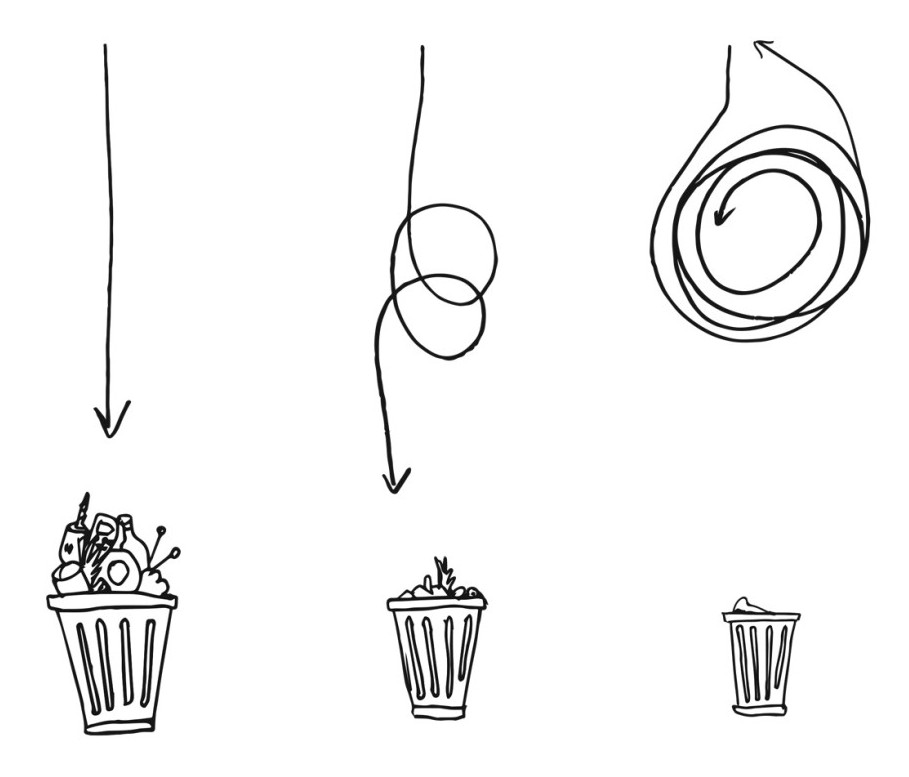

Meanwhile, U.S. banks and CEOs continue to educate us on the culture of corporate kleptocracy. Take Citigroup, which hogged $45 billion of public money at the bailout trough. Soon after, it sought to spend $50 million on a corporate jet - a move that had to be squelched at the level of the Treasury Secretary. The now disgraced CEO of Merrill Lynch, John Thain, spent $1.22 million on redecorating his office in early 2008. That is, even as he prepared to cut thousands of jobs. The amount included purchase of an antique "commode on legs." Heavy symbolism there, given the company was by then halfway down the tube with massive losses. Less than a week after the U.S. government committed $85 billion in bailout money to AIG, the insurance company's executives whizzed off to a luxury resort where rooms could cost over $1000 a night. Blowout followed bailout. Wells Fargo ($25 billion in bailout money) laid on a trip to Las Vegas for its star execs.

Top bosses of New York financial firms paid themselves bonuses worth $18 billion in 2008. The kleptocrats clearly believe that the crisis - one that has their personal stamp on it - is for others. They themselves flourish by divine right. And the bailouts seem to confirm that. The very gangs that spurred the meltdown are rewarded with huge amounts of taxpayer money so that they can go back to doing the same things they were doing before.

Meanwhile tens of millions of human beings across the world stand to lose their jobs. Many will descend into distress and chaos. The already hungry will have it much worse. Whose crisis is it, anyway?